Car title loans provide quick cash using your vehicle's title as security, but failure to repay on time can result in repossession and potential sale of your car. These short-term loans carry significant risks, including legal implications, and vary by state. To avoid default, borrowers should stick to repayment plans, consider debt consolidation, or sell the vehicle to clear the loan while protecting other assets. Understanding these strategies helps responsibly navigate car title loan challenges, like how they work and associated dangers.

Car title loans, a quick source of cash secured by your vehicle, offer immediate relief for financial emergencies. However, understanding the default process is crucial before borrowing. This article delves into the mechanics of car title loans and what happens when you’re unable to repay. We explore legal consequences, potential outcomes, and repayment options, providing insights into managing this type of loan responsibly. By grasping these fundamentals, borrowers can make informed decisions regarding short-term financing.

- Understanding Car Title Loans Basics

- Default Consequences: Legal Implications

- Repayment Options When You Can't Pay

Understanding Car Title Loans Basics

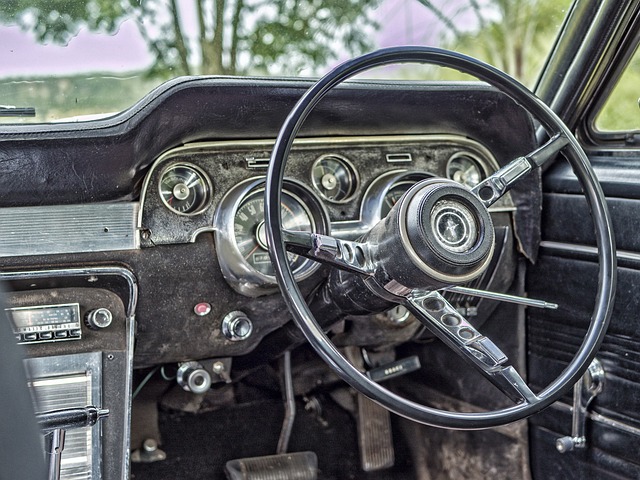

Car title loans are a type of secured lending that uses your vehicle’s title as collateral. It’s a quick way to access cash, especially for those with poor or no credit history who might not qualify for traditional bank loans. Here’s how it generally works: You hand over your car title (a legal document proving ownership) to the lender, and they provide you with a loan based on the value of your vehicle. The loan terms typically involve regular payments over a set period, often ranging from 30 days to a year. Failure to repay the loan on time can result in repossession of your vehicle.

Loan eligibility requirements vary among lenders, but generally, you need a valid driver’s license, proof of insurance, and a clear car title. While Houston title loans are popular for their accessibility, it’s crucial to understand the loan terms and potential consequences of defaulting on these short-term loans before pledging your vehicle as collateral.

Default Consequences: Legal Implications

When you take out a car title loan, it’s crucial to understand that there can be significant consequences if you fail to make the required payments on time. In many cases, when borrowers default on their loans, lenders have legal options to recover the outstanding balance. This can include repossession of the vehicle, which is a key aspect of how these secured loans work. Once the car is seized, the lender may choose to sell it to recoup the loan amount. The process varies by state, but it generally involves legal proceedings and court orders.

These legal implications highlight the importance of adhering to the agreed-upon repayment terms. Unlike unsecured loans, which might offer more flexible payments, car title loans are backed by the vehicle itself, making default a more serious matter. Borrowers should be mindful of their financial obligations and consider whether debt consolidation or other strategies could help manage payments if they anticipate difficulties in meeting loan terms.

Repayment Options When You Can't Pay

If you find yourself unable to make your car title loan payments as agreed upon, it’s crucial to understand your repayment options. One common scenario is to negotiate with your lender for a repayment plan or extension. Many lenders are willing to work with borrowers facing financial difficulties, especially if they have been consistent with their initial loan payments. An extended repayment period can provide some relief and allow you to catch up without immediately risking default.

Another option, depending on the terms of your loan agreement and your vehicle’s current value, is to sell the vehicle in question. This could be an emergency funding solution that allows you to pay off the loan and keep your other assets intact. It’s important to remember that while car title loans can offer quick access to cash, they come with the condition that the lender has a security interest in your vehicle until the debt is repaid.

Car title loans, while offering quick cash solutions, come with significant risks in case of default. Understanding the legal implications and repayment options is crucial before taking such a loan. If you’re unable to make payments, know that there are ways to navigate the situation, but it’s essential to act promptly to avoid severe consequences. By staying informed about how car title loans work and their potential outcomes, borrowers can make informed decisions to protect their assets and financial well-being.