Car title loans provide quick cash using a vehicle's title as collateral, but they come with risks like repossession if payments lag. Lenders assess vehicle value for loan eligibility and offer shorter repayment periods compared to traditional loans. Understanding the potential pitfalls of defaulting, including deficiency judgments, is crucial for informed borrowing decisions. Exploring alternative financial solutions before default can help borrowers mitigate harsh repercussions and maintain essential transportation or income sources.

“Discovering how car title loans operate is crucial for borrowers looking into this unique financing option. This article provides a comprehensive overview, starting with the basics of car title loans—how they function as a secured loan using your vehicle’s title as collateral. We then delve into the consequences of defaulting, exploring potential outcomes and available solutions. By understanding these dynamics, borrowers can make informed decisions and mitigate adverse effects when seeking car title loan alternatives.”

- Understanding Car Title Loans: A Comprehensive Overview

- What Happens When You Default on a Car Title Loan?

- Mitigating Consequences and Exploring Alternatives

Understanding Car Title Loans: A Comprehensive Overview

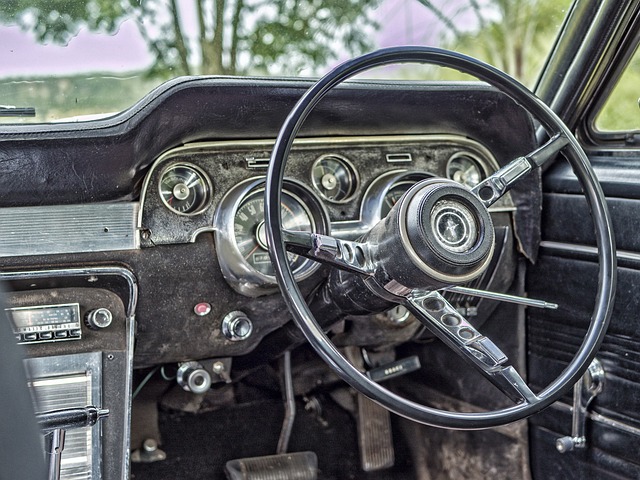

Car title loans are a type of secured lending where individuals use their vehicle’s title as collateral to secure a loan. This alternative financing option is designed for borrowers who need fast cash and may not qualify for traditional bank loans or credit lines. The process involves a straightforward application, where lenders evaluate the car’s value, typically based on its make, model, year, and overall condition. If approved, the borrower receives a lump sum of money, often with a shorter repayment period compared to other loan types.

In the event of default, things can become more complex. Lenders have the right to repossess the vehicle if payments aren’t made as agreed upon. This means borrowers must be mindful of their repayment options and schedule. Some lenders offer flexible repayment terms and the chance to regain ownership after a certain period of timely payments. For instance, Houston title loans providers might provide fast cash within 24 hours, but borrowers should explore various repayment plans to manage their debt effectively without facing repossession risks.

What Happens When You Default on a Car Title Loan?

When you take out a car title loan, lenders hold onto the title of your vehicle as collateral until the loan is repaid in full. If you’re unable to make the required payments on time, it triggers a default situation that can lead to several consequences. The lender will first attempt to work with you to find a solution, such as adjusting repayment terms or helping you catch up. However, if the default persists, they may initiate repossession proceedings.

During repossession, the lender takes physical possession of your vehicle and facilitates its sale to recover the outstanding loan balance. The process varies slightly depending on state laws, but typically, you’ll receive notice before the car is seized. In some cases, if the vehicle’s value is lower than the remaining debt, you may still be on the hook for the difference, known as a deficiency judgment. This can create financial strain, especially in cities like Fort Worth and San Antonio where cars are essential for daily life and transportation options are limited without personal vehicles.

Mitigating Consequences and Exploring Alternatives

When you default on a car title loan, understanding the consequences is crucial. The lender typically repossesses the vehicle, ending all ownership rights. This can be devastating for borrowers who rely on their cars for daily commuting or even as a source of income through ridesharing services. However, there are strategies to mitigate these harsh repercussions and regain financial stability.

Exploring alternative financial solutions before defaulting is key. Consider seeking emergency funds from reliable sources like family, friends, or credit unions. If feasible, negotiate with the lender for a repayment plan or extended terms. Additionally, looking into other loan options or even bankruptcy protection might be viable, offering a chance to regroup and rebuild without the immediate threat of vehicle repossession. These alternatives can help borrowers steer clear of the most severe consequences while prioritizing their financial well-being moving forward.

When considering a car title loan, understanding what happens in case of default is crucial. These loans are a quick financial solution, but non-payment can lead to severe consequences, including repossession and additional fees. However, proactive measures like prioritizing loan repayment or exploring alternative financing options can help mitigate these outcomes. By educating yourself on how car title loans work and being prepared for potential defaults, you can make informed decisions to manage your finances effectively.