Car title loans provide quick emergency funding by using your vehicle's title as collateral, skipping traditional bank checks. The process is simple: contact a specialist, assess vehicle value, provide proof of ownership and ID, meet eligibility criteria, get approved, and receive funds within 30 minutes. Repayment keeps your vehicle as collateral until the loan is fully repaid.

In moments of financial emergency, understanding how car title loans work can offer a lifeline. This article guides you through this unique funding option, providing a clear overview and step-by-step process. We’ll explore who qualifies for these loans and dispel any myths about the complexities of securing one. Discover how quickly you can access cash using your vehicle’s title as collateral, ensuring peace of mind during challenging times.

- Understanding Car Title Loans: A Quick Overview

- Eligibility Criteria for Emergency Funding

- The Process: How to Secure a Loan Quickly

Understanding Car Title Loans: A Quick Overview

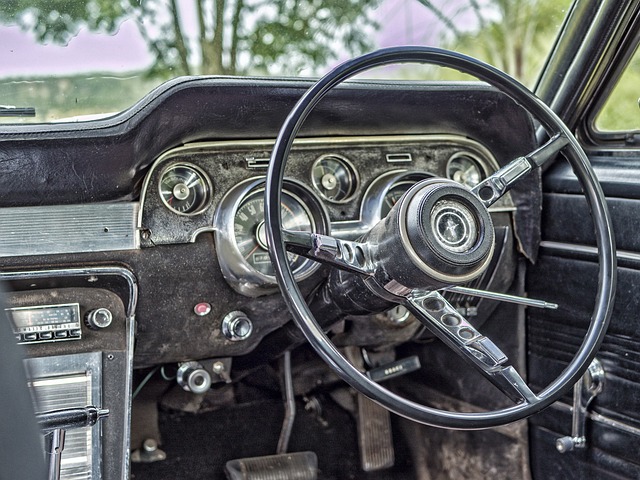

Car title loans are a type of short-term financing option where borrowers use their vehicle’s title as collateral. This alternative lending method is designed for individuals in urgent need of cash, offering a quick and convenient solution during emergencies. Instead of traditional bank loans that require extensive paperwork and strict credit checks, car title loans provide faster access to funds by leveraging the value of one’s vehicle.

The process involves a simple three-step approach: applying for the loan, providing necessary documents, and signing over the vehicle’s title temporarily. Lenders assess the vehicle’s condition and its market value to determine the loan amount. Unlike credit checks in conventional loans, car title loans focus more on the vehicle’s equity than the borrower’s credit history, making them accessible to those with less-than-perfect credit or no credit at all. Once approved, borrowers receive their funds within a short period, providing immediate relief during emergencies.

Eligibility Criteria for Emergency Funding

When considering a car title loan as an emergency funding option, understanding the eligibility criteria is key. Lenders will typically assess your vehicle’s value, your ability to repay the loan, and your personal information. This means providing proof of ownership, a valid driver’s license, and potentially a government-issued ID. The process often involves a quick credit check to determine your financial trustworthiness, but many lenders focus more on the equity in your vehicle than your credit score.

Loan eligibility can vary between lenders, but generally, you need to be at least 18 years old, have a clear vehicle title in your name, and have a steady source of income. Some lenders may also require a co-borrower or ask for references. The goal is to ensure responsible lending and responsible borrowing during what is often a stressful time. With the right documentation and qualifications, same-day how do car title loans work approvals can provide much-needed cash in emergencies.

The Process: How to Secure a Loan Quickly

When faced with an emergency that requires immediate financial assistance, understanding how car title loans work can be a game-changer. The process is designed to be quick and efficient, allowing you to access emergency funding in as little as 30 minutes. It starts by contacting a lender who specializes in car title loans, either online or through a local office in San Antonio Loans. You’ll need to provide proof of ownership for your vehicle, typically the title, along with valid identification and insurance information.

The lender will assess your vehicle’s value and offer you a loan amount based on that appraisal. One key advantage of car title loans is that they allow you to Keep Your Vehicle during the repayment period. Unlike traditional loans where you might need to hand over your car as collateral, car title loans let you retain possession while making fixed payments over a set period. Once the loan is fully repaid, the title is returned to your name.

Car title loans can be a swift solution during emergencies, offering access to immediate funding secured against your vehicle. By understanding the process and eligibility criteria, you can navigate this option efficiently. When life throws unexpected challenges, knowing how car title loans work can provide much-needed relief, ensuring you have the resources to handle urgent situations promptly.