Car title loans in San Antonio offer quick cash using your vehicle's title as collateral, with flexible terms and competitive rates despite relaxed credit checks. Lenders assess your car's value for loan amounts, and borrowers retain control over repayment schedules. This direct deposit option provides immediate financial assistance, addressing misconceptions about interest charges and approval processes.

Car title loans have gained popularity as a quick financial solution, but many myths surround their operation. This article aims to demystify this process and provide a clear understanding of how car title loans truly function. We’ll explore the basics of unlocking equity through your vehicle’s title, debunk common interest rate myths, and discuss flexible repayment options available to borrowers. By the end, you’ll have a comprehensive view of what to expect when considering a car title loan.

- Unlocking Car Equity: The Basics of Title Loans

- Debunking Myths: Truths About Interest Rates

- Repayment Options: Flexibility in Loan Structure

Unlocking Car Equity: The Basics of Title Loans

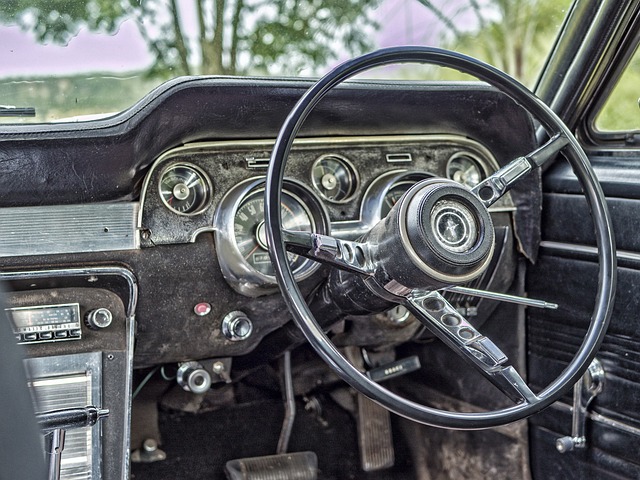

Car owners often find themselves in situations where they need quick access to cash. This is where car equity comes into play, offering a potential solution through car title loans. Unlocking this financial opportunity involves using your vehicle’s title as collateral for a secured loan. It’s a simple process that allows individuals to borrow money based on the value of their automobile.

In the case of San Antonio loans, or title pawns, as they’re sometimes called, lenders assess the vehicle’s condition and current market value to determine the loan amount. This alternative financing method is appealing for those seeking immediate funds without strict credit requirements. The interest rates vary among lenders, so it’s essential to compare offers before pledging your car’s title. By understanding how these loans work, borrowers can make informed decisions, ensuring they receive the best terms and conditions tailored to their needs.

Debunking Myths: Truths About Interest Rates

Many people who are considering a car title loan for fast cash often come across misconceptions about interest rates and how these loans work. One common myth is that car title loans have significantly higher interest rates than traditional loans, making them an unattractive option. However, the truth is that interest rates on car title loans can be quite competitive when compared to other short-term financing options. Lenders who offer these loans understand that borrowers are often in need of quick cash and thus provide transparent terms, including fixed interest rates that are clearly outlined in the loan agreement.

Another misconception is that vehicle collateral ensures instant approval for any amount requested. While having a vehicle as collateral does speed up the lending process, it doesn’t guarantee approval for any loan amount. Lenders assess each borrower’s financial situation to ensure repayment capacity, similar to traditional loans. Moreover, direct deposit of funds is often possible with car title loans, providing borrowers with fast cash access once approved. This efficient process helps individuals in urgent need of fast cash without the lengthy waiting times associated with other types of loans.

Repayment Options: Flexibility in Loan Structure

When exploring how do car title loans work, understanding repayment options is crucial. Unlike traditional loans that often come with rigid payment schedules, car title loans offer a more flexible approach to repayments. Lenders typically structure these loans as a line of credit, allowing borrowers to choose when and how much they repay. This flexibility enables individuals to make payments according to their financial comfort levels, whether it’s settling for smaller amounts during lean times or larger sums when possible.

One significant advantage is the ability to keep your vehicle throughout the loan period. Unlike with traditional collateral loans where the lender may retain possession of your asset until full repayment, car title loans let you maintain control over your vehicle as long as you make timely payments. This feature, often referred to as a “keep your vehicle” policy, ensures that even if you’re obtaining a loan based on your vehicle’s equity, you still have access to it for daily use without fear of repossession.

Car title loans offer a unique financial solution, allowing borrowers to tap into their vehicle’s equity. By understanding the truth behind these loans—from interest rates to repayment flexibility—you can make an informed decision. Remember, while car title loans provide access to quick cash, it’s crucial to choose reputable lenders and manage your repayments carefully to avoid potential pitfalls. Knowing how they work is the first step in navigating this option wisely.